How one GlueX API helped supercharge Hyperwave’s hwHLP Vault by 2.4x

Learn how Hyperwave unlocked deposits from any-token into its hwHLP vault, boosted TVL by 240%, and gained instant Pyth oracle coverage, supported by a single GlueX integration

Last month, Hyperwave, backed by Swell Labs, launched hwHLP, the first liquid Hyper Liquidity Provider (HLP) token on HyperEVM.

When hwHLP debuted, it became the first ever liquid token that accrues yield from the Hyperliquidity Provider vault (HLP).

hwHLP lets you profit from market making and liquidations on Hypercore, while retaining your liquid assets for DeFi on HyperEVM and beyond.

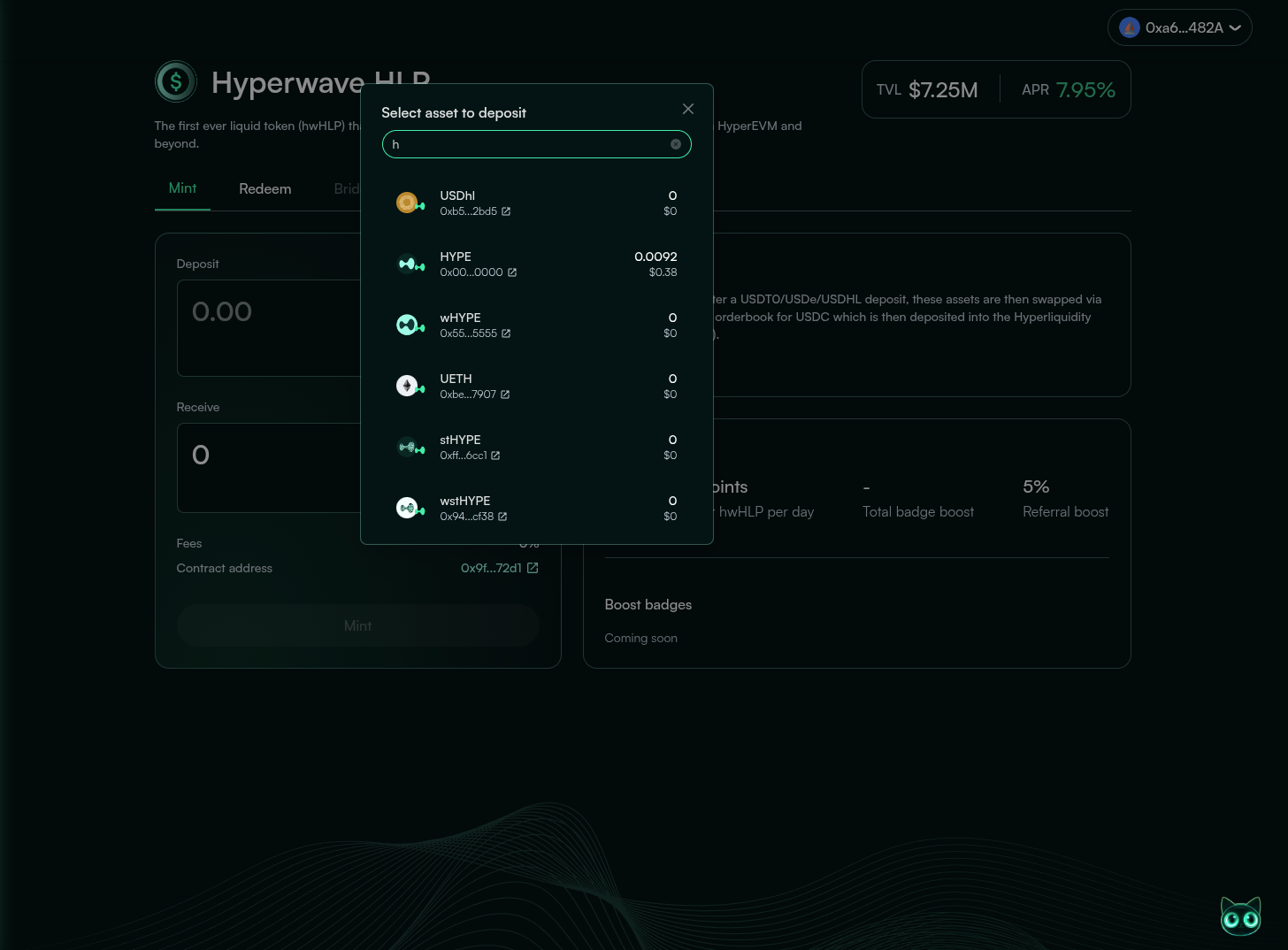

There was only one problem. The hwHLP vault only accepted deposits in a limited set of assets - USDT₀, USDe and USDHL.

Before: Deposit USDT₀ or USDe → HLP vault → Mint hwHLP

Although, the utility and the uniqueness of this vault was lucrative enough to make up for the fact that it only accepted deposits in 3 tokens, the Hyperwave team wanted to give the best UX possible to it’s users

—Kizen, Marketing Lead at Hyperwave

Why GlueX?

Hyperwave needed:

- Deposits from any token into hwHLP Vaults

- Deposits at best prices on HyperEVM

Enabling this was easy for GlueX. Already, GlueX gave the best prices for majority of token pairs on HyperEVM thanks to the expansive number of DeFi modules already integrated and it’s powerful optimizer network that powers more than $ 100 million monthly.

GlueX already supports 1000s of different liqudity modules, as it is serves as the semantic and execution layer of DeFi. Integration of a new custom module was no difficult feat, and was completed within 24 hours. Post the integration, this liquidity module was available across all the GlueX APIs.

The GlueX Router API delivers zaps into hwHLP Vault with just one call, at the best prices by splitting volume optimally across liquidity sources.

All that was left was for Hyperwave to integrate this into their frontend.

Integration Details

Router API Integration on Frontend

Hyperwave wired GlueX into its frontend with minimal code:

async function minthwHLP(

client: Client,

fromToken: string,

fromAmount: string,

userAddress: string

): Promise<Hash> {

const quoteResponse = await axios.post(

"https://router.gluex.xyz/v1/quote",

{

inputToken: fromToken,

inputAmount: fromAmount,

outputToken: "0x9fd7466f987fd4c45a5bbde22ed8aba5bc8d72d1", // hwHLP

userAddress,

chainID: "hyperevm",

uniquePID: GLUEX_INTEGRATOR_ID,

},

{

headers: {

"content-type": "application/json",

"x-api-key": GLUEX_API_KEY,

},

}

);

const { result } = quoteResponse.data;

// Approve if not native token

if (!isNativeToken(fromToken)) {

const allowance = await client.readContract({

address: fromToken as Address,

abi: ERC20_ABI,

functionName: "allowance",

args: [userAddress as Address, result.router as Address],

});

if (allowance < BigInt(fromAmount)) {

const approveHash = await client.writeContract({

address: fromToken as Address,

abi: ERC20_ABI,

functionName: "approve",

args: [result.router as Address, maxUint256],

});

await client.waitForTransactionReceipt({ hash: approveHash });

}

}

// Execute swap

const swapHash = await client.sendTransaction({

to: result.router as Address,

data: result.calldata as `0x${string}`,

value: BigInt(result.value),

});

return swapHash;

}Within just minutes, it was possible to build fully functional “any-token → hwHLP” zap flow in the Hyperwave UI

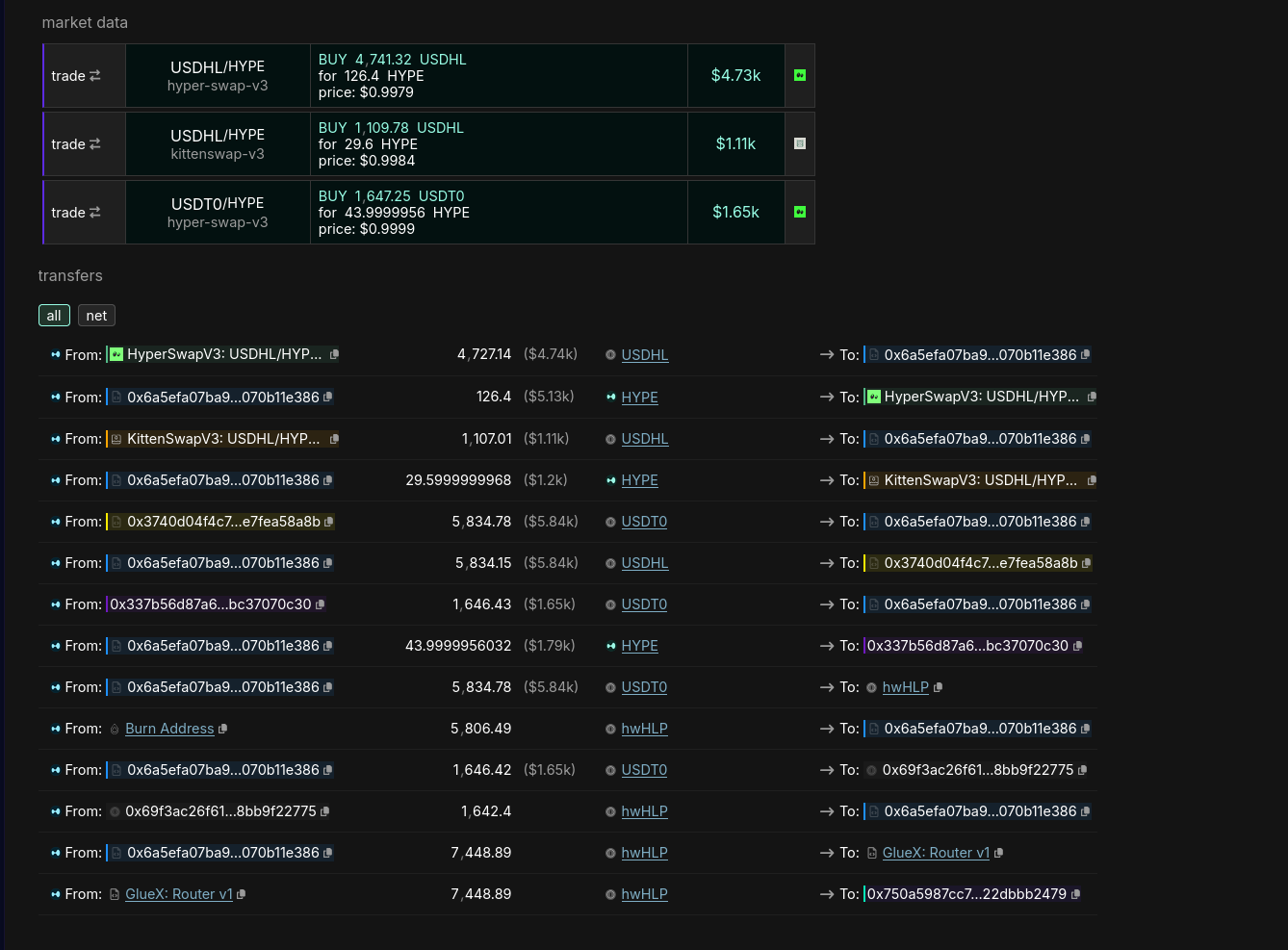

Routing Optimizations & Additional Unlock

GlueX’s optimizer intelligently splits each zap across multiple liquidity sources: primary vaults, secondary markets, and spot pools. All done to ensure that users secure the best rates:

- User → GlueX → Market A + Market B + Market C → Vault

- Minimal slippage, no manual routing

Here’s an example of a transaction that split $HYPE across multiple markets, then re-deposited into the vault and issued the token to the user in one atomic call.

“Seeing GlueX split volume across primary and secondary whHLP markets in real time was incredible”

—Abi, Strategy Lead at Hyperwave

A core unlock that became possible with the GlueX Integration was the fact that the hwHLP token was not just accessible via the Hyperwave frontend but also via all the integrators that are using GlueX’s Router API. This includes Valantis, HypurrFi, Definitive.fi, Okto Wallet and of course the GlueX dApp itself.

With just one integration, the hwHLP token got access to almost all the orderflow on HyperEVM. This is the power of the semantic and execution abstraction layer that GlueX has built.

Results & Metrics

10 days post-integration, vault deposits jumped by 2.4x.

| Metric | Pre-GlueX | 10 days Post-GlueX | % Change |

|---|---|---|---|

| hwHYPE TVL | 2.15 mn | 7.46 mn | + 246.51% |

“Integration was plug-and-play. Seeing continued TVL growth validated our decision”

—Kizen, Marketing Lead at Hyperwave

Instant Oracle Robustness

If a liquidity module is integrated into the GlueX Protocol, each pool and token part of the module becomes accessible via all of GlueX’s APIs, including the Exchange Rates API.

Thanks to this API and the fact that GlueX is also a data publisher for Pyth, the hwHLP token was indexable the moment that the liquidity module was integrated. Pyth automatically picked up the hwHLP/USDC feed with no manual setup required.

Continuous liquidity also ensured the oracle spreads tight and users got the right price.

But the biggest unlock this gave was the ability to instantly power the new hwHLP/USDT0 market on Hypurrfi with a live on‑chain price oracle feed from Pyth. This integration delivers three major benefits for Hypurrfi:

Direct price feeds via Pyth

Hypurrfi can pull hwHLP prices directly from Pyth, using GlueX’s publisher role, no custom oracle integration needed.

Tight, accurate quotes

Continuous liquidity in the GlueX module keeps spreads narrow, so Hypurrfi’s traders always see the right price.

Zero‑touch onboarding

As soon as the liquidity module was integrated into GlueX, the hwHLP/USDT0 market could go live on Hypurrfi with a robust, decentralized oracle feed.

By combining GlueX’s liquidity routing and Pyth’s oracle infrastructure, any market built on Hypurrfi (or any other integrator) can launch with institutional‑grade pricing immediately.

Developer UX Flow

Hyperwave’s front-end now offers:

- Select any token on HyperEVM

- Enter amount

- Click “Mint hwHLP”

No approvals. No extra transactions. Just one seamless call.

What’s Next

Hyperwave’s launch is just the beginning, and it’s already pushing the boundaries of what’s possible on HyperEVM.

If you’re building on HyperEVM ( or any other EVM chain), plug in GlueX:

TLDR : With GlueX’s Router API Hyperwave transformed hwHLP vaults by enabling deposits from any token. Subsequently, hwHLP also received instant Pyth oracle indexing thanks to GlueX being a publisher on Pyth.