Beyond the Norm : Unlocking True LVF Liquidity with Peapods

Discover how GlueX Router’s protocol specific liquidity modules bring full support for Peapods Finance primitives like pTokens and LVF pods - enabling smarter, fairer and more efficient trade routing across DeFi

DEX aggregators are built on a simple promise: to find the best route between any two tokens. In practice, however, most of them search for liquidity in the same places — the most common DEXs, AMMs, and liquidity hubs that already dominate on-chain volume.

It’s an efficient approach from an engineering perspective. Common DEXs share similar interfaces, liquidity models, and APIs, so integrating them is straightforward. But it also creates a systemic blind spot across the aggregation landscape that largely impacts innovative protocols such as Peapods Finance.

Peapods Finance Liquidity Aggregation

Peapods Finance pioneered mechanisms such as pTokens (wrapped representations of vault assets) and LVF — Leveraged Volatility Farming — which allow users to create self-contained, yield-generating pods. These are not just ERC-20s; they are dynamic systems with internal wrapping, unwrapping, and paired-asset logic.

However, every DEX aggregator has failed to recognize these structures and defaulted to routing trades through Peapods assets without taking into account their internal mechanics. This results in inefficient routing, missed arbitrage opportunities for legitimate users, and often — value extraction by MEV bots who exploit the price discrepancies between pTokens and their underlying assets.

Optimized Routing with GlueX

At GlueX, we believe aggregation should mean understanding, not just indexing. Instead of limiting routing to the most common DEXs, we build protocol-specific Liquidity Modules that go deep into how each system actually works.

For Peapods Finance, this meant fully integrating all of its primitives — including pTokens, LVF pods, and internal wrap/unwrap routes — directly into the GlueX Router.

With these modules, GlueX can identify the real optimal path — one that might involve wrapping into a pod or unwrapping at the final step — all executed seamlessly within a single transaction.

The result:

- Better rates and lower slippage for users.

- No value leakage to external MEV bots.

- Fair routing that respects the protocol’s internal economics.

How GlueX Routing Differs

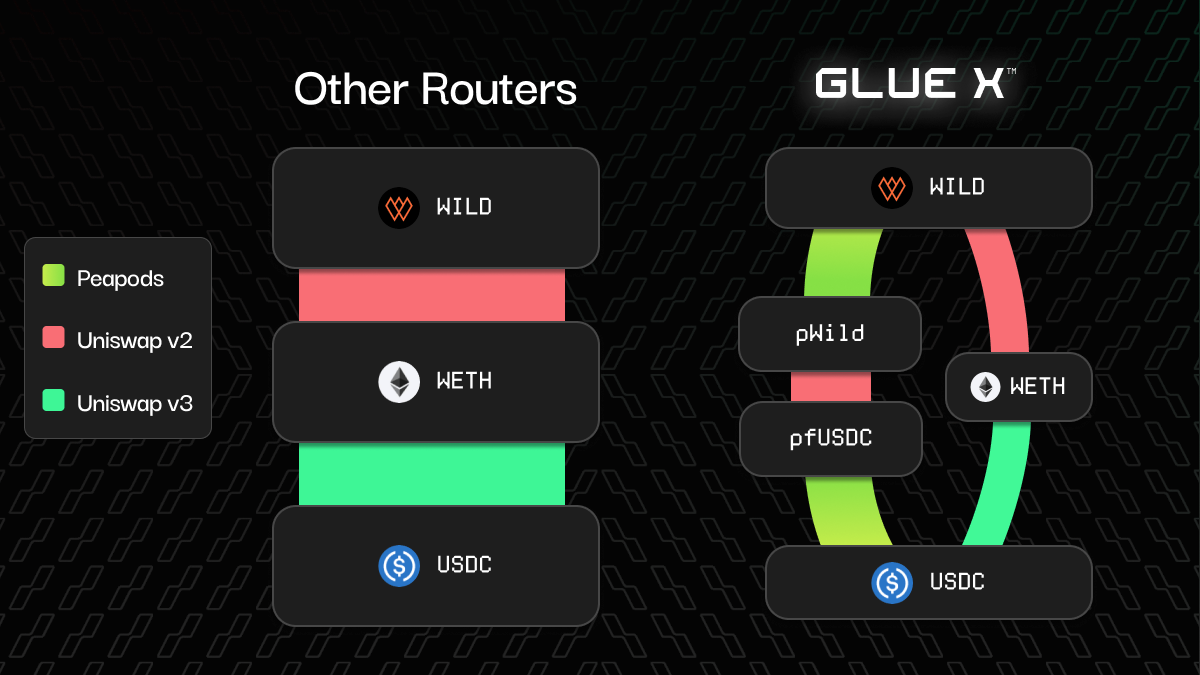

The illustration below compares a typical DEX aggregator’s routing logic versus GlueX’s composability-aware routing.

Other routers limit themselves to surface-level liquidity, swapping directly between major pools like Uniswap v2/v3.

GlueX, on the other hand, understands Peapods’ internal mechanics, seamlessly wrapping into pWILD and unwrapping from pfUSDC within the same transaction to extract the best outcome.

The Results

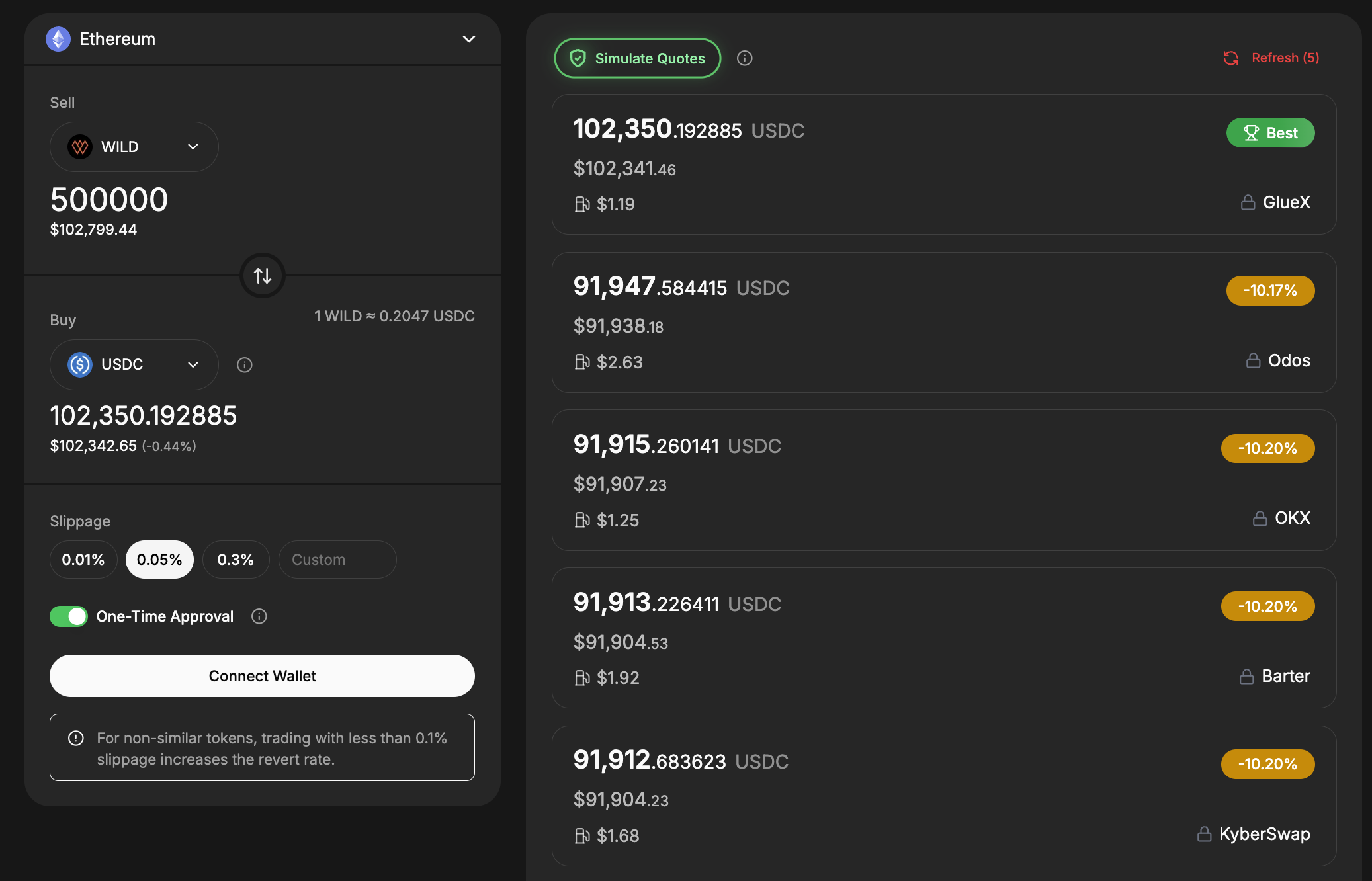

When tested through meta.matcha.xyz — the meta-aggregator that simulates real on-chain calldata, GlueX’s pod-aware routing consistently outperformed leading DEX aggregators.

Here’s an example of an Ethereum trade swapping 500,000 WILD for USDC. GlueX delivered a substantially better execution price than every other route analyzed:

- GlueX: 102,350.19 USDC

- Odos: 91,947.54 USDC

- OKX: 91,915.26 USDC

- Barter : ~91,913 USDC

That’s a 10.2% price improvement, or roughly $10,000 more value on a single six-figure swap.

And this isn’t a one-off. Wherever GlueX sees an opportunity to deliver more value via routing through Pods, it smartly captures it to ensure users get the best value.

Each new Pod effectively adds another liquidity layer that GlueX’s routing logic can automatically detect and leverage. Where others see isolated vault tokens, GlueX sees composable liquidity systems, creating a structural advantage that compounds with every integration.

The Future of Smart Aggregation

As DeFi continues to evolve, protocols will keep innovating at the primitive level — and aggregation logic will need to evolve with it. Integrating “the top 10 DEXs” is no longer enough. The real efficiency lies in composability-aware routing, where each protocol’s unique liquidity logic becomes a first-class citizen in the routing engine.

GlueX Router’s work with Peapods Finance demonstrates what’s possible when aggregation goes beyond surface-level liquidity. By treating each protocol as an ecosystem, not a plugin, we enable DeFi to function as it was originally envisioned: open, efficient, and truly interoperable.

Explore further: